In partnership with the U.A.E. Ministry of Finance and the U.S.-U.A.E. Economic Policy Dialogue, the U.S.-U.A.E. Business Council strongly encourages member companies to register for a series of briefing updates on VAT and Excise Taxes that the U.A.E. Ministry of Finance will convene over the next two months.

In coordination with other GCC states, the U.A.E. is currently preparing to implement a 5% VAT on many goods and services from January 1, 2018. At the same time, the U.A.E. plans to soon implement Excise Taxes on tobacco products, carbonated drinks, and energy drinks.

To help companies prepare for these important developments and provide further details, the Ministry of Finance announced on 21 March 2017 a series of “Awareness Session” designed to make business aware of the key policies, implementation procedures, and deadlines. The first session in this series was convened for “multipliers”, such as Advisory Businesses, on 21 March 2017. For a summary of key outcomes from this meeting, please see this EY Global Tax Alert.

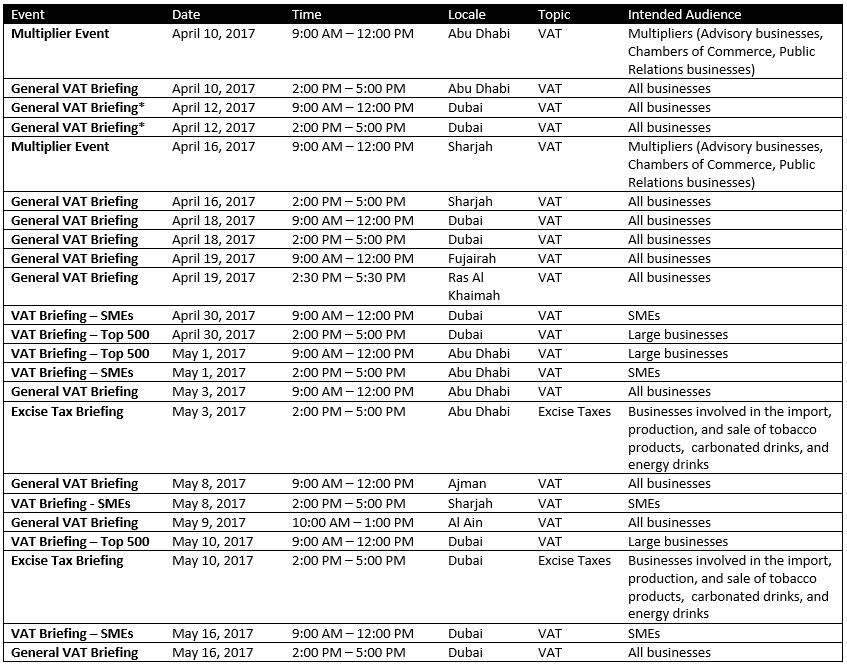

For a schedule of upcoming Awareness Sessions, please see the chart below. To register to attend and of these sessions, please visit the Ministry of Finance’s webpage here.